Image Credit: Nikolas Strugar/ Ravens at Odds

In an analysis of labour force movements for Australia’s 56 regions (Greater Capital City Areas and SA4’s outside Greater Capital City Areas) over the past 12 months it appears that the Australian Government’s $311 billion COVID boost and complimentary State and Local Government funding initiatives, have resulted in some regional winners and losers.

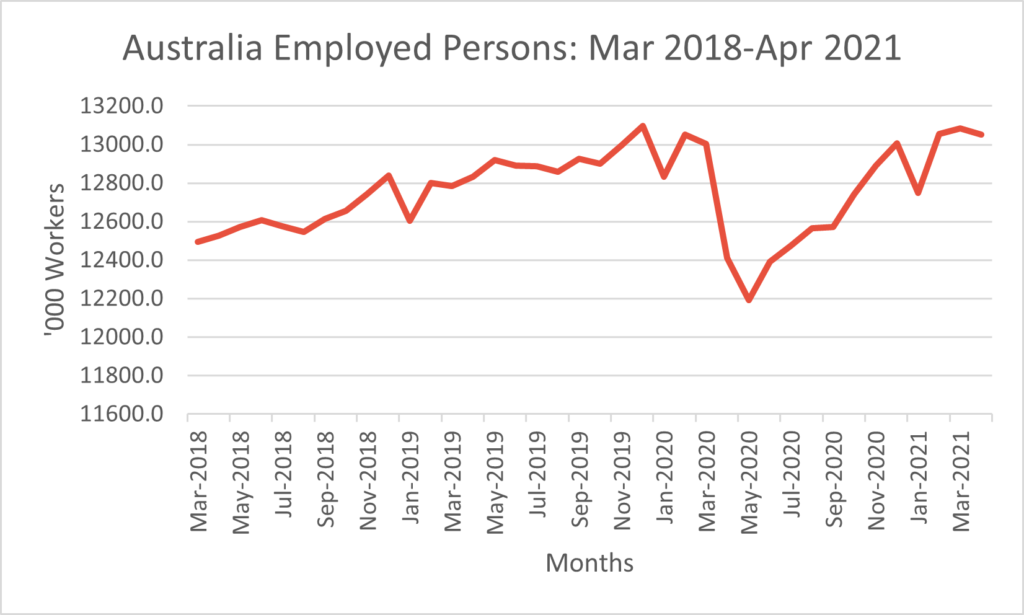

The COVID-19 induced slowdown (including two quarters of recession) hit Australian workers hard in April 2020 before bottoming out two months later in May. Government stimulus then started to support workers with employment levels regaining their pre-COVID levels in February 2021.

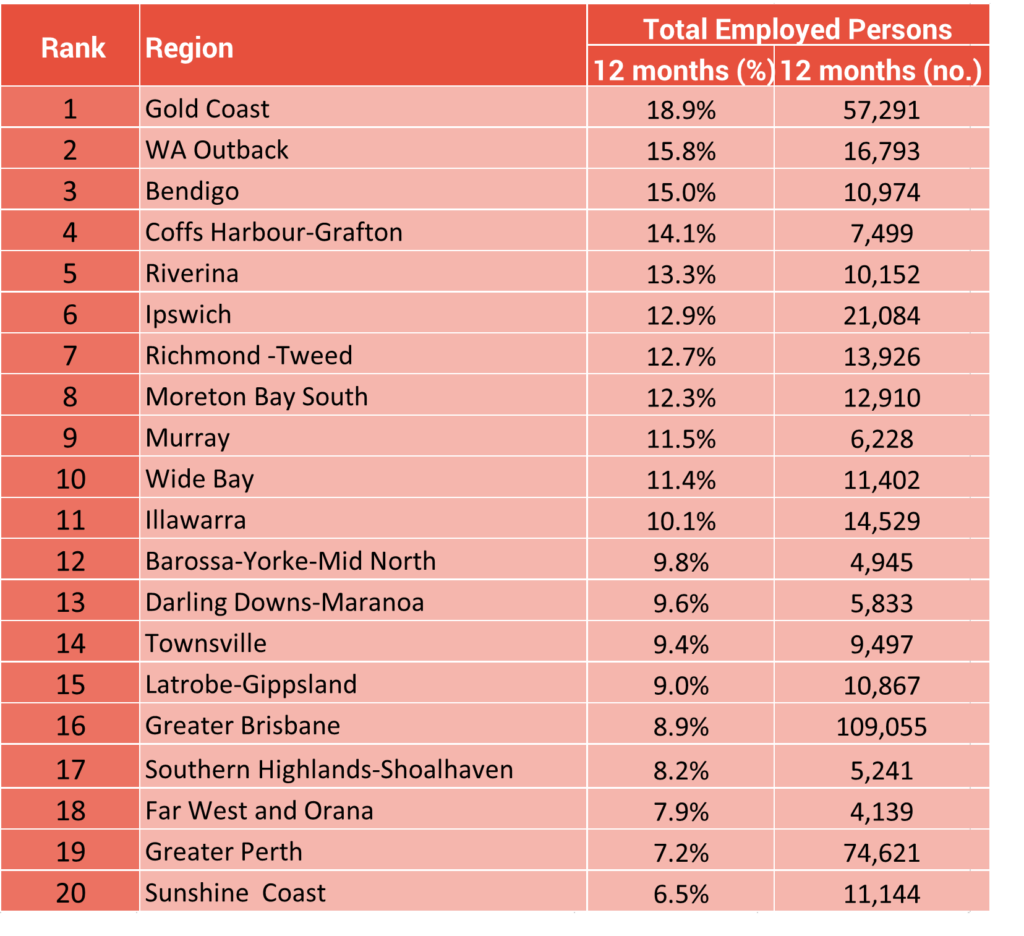

Across Australia though employment impacts from COVID-19 have varied widely. Queensland has generally done well accounting for eight (8) of the 20 fastest growing regions across Australia, followed by New South Wales with seven (7). After the Gold Coast the next fastest growing labour force region has been the Western Australian Outback (15.8%) which incorporates most of Western Australia’s resource regions. This area has benefited from high iron ore prices which have driven strong export volumes.

Bendigo in regional Victoria has also seen strong labour force growth (15%), potentially at the expense of Greater Melbourne as workers fled the city in search of safer living and working environments.

Other Queensland regions to perform well have been Ipswich (12.9% growth); Moreton Bay South (12.3%) which includes the Strathpine and North Lakes areas; Wide Bay (11.4%); Darling Downs-Maranoa (9.6%); and Townsville (9.4%).

Greater Brisbane (8.9% growth) has also performed relatively well and is the best performed Greater Capital City Area ahead of Greater Perth (7.2%); Greater Adelaide (6.1%); Greater Sydney (4.8%); and Greater Melbourne (4.3%).

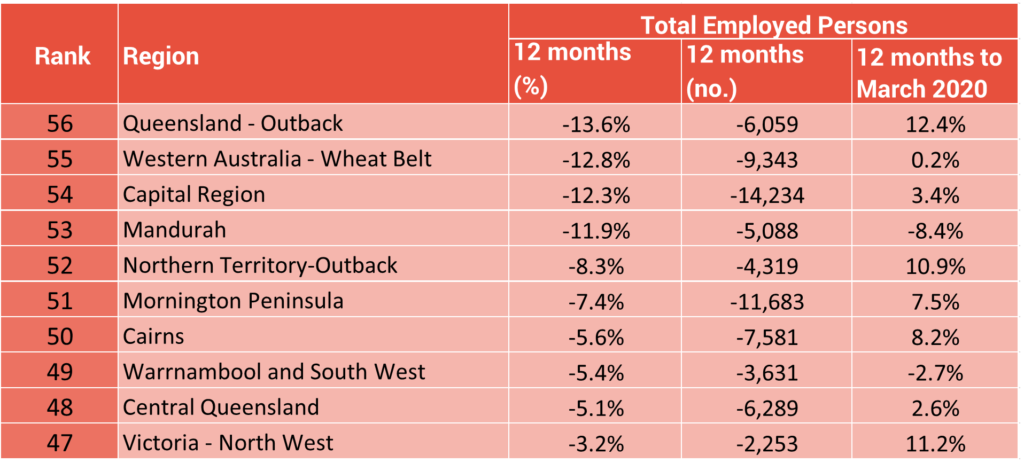

At the other end of the scale, a number of regions have seen their labour force levels decline, particularly rural and remote areas. Worst hit have been Queensland Outback (-13.6%); the Western Australian Wheat Belt (-12.8%); and New South Wales Capital Region (-12.3%). For a number of these regions this loss in labour force follows relatively strong growth the year before making the social impact particularly acute for these regional areas.

For more economic insight into Australia’s employment market, please contact our specialist directly.

Senior Consultant