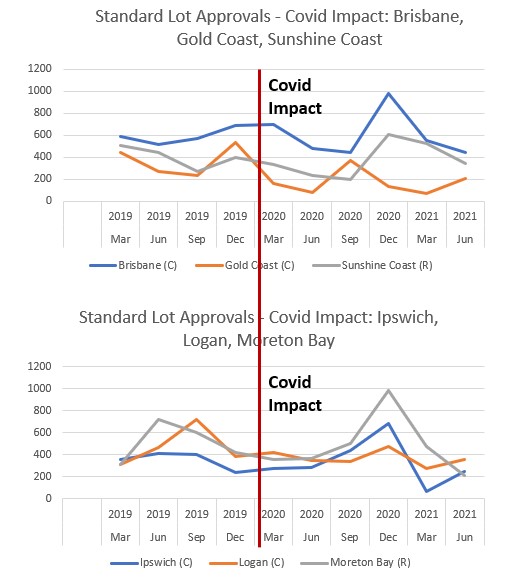

The following charts show Standard Lot Approvals (60m2 to <2,500m2) for SEQ’s major residential development LGAs – Brisbane, Gold Coast, Sunshine Coast, Ipswich, Logan, and Moreton Bay. Separating these areas into Brisbane and the Coasts; and the traditional mortgage belts of Ipswich, Logan, and Moreton Bay, highlights the different impacts that Covid-19 has had on these LGAs. For Brisbane, the Gold Coast, and the Sunshine Coast the impact from Covid-19 was quite significant, though it is worth noting that the Gold Coast and Sunshine Coast development markets had already slowed prior to the onset of the pandemic.

For Ipswich, Logan, and Moreton Bay, Covid-19 had very little apparent impact on residential development activity with lot approval rates generally remaining steady from March 2020 to September 2020. However from September 2020 and specifically the December quarter, lot approval rates took off across all the major development LGAs in a response to the introduction (and flow through) of the Federal Government’s HomeBuilder initiative.

So why might this have been the case? Well perhaps the answer is in what was happening before Covid-19 hit. For Ipswich, Logan, and Moreton Bay lot approval levels had peaked around six months before the pandemic hit Australia in March 2020. By the time Covid-19 arrived these markets had already bottomed. Whereas for the Gold Coast and Sunshine Coast development market activity only peaked in December 2019 and had only just started coming off its peak when the pandemic hit. Brisbane was slightly behind the cycle and was peaking when the pandemic hit and subsequently slowed for longer than most of the other markets.

Another interesting observation is that after peaking around December 2020, Brisbane, Gold Coast, Sunshine Coast, and Logan appear to have returned to levels of stability. The Ipswich and Moreton LGAs however, fell below their peaks with Ipswich only starting to show a return to pre-covid levels in the June 2021 quarter.

The big question though is where to from here? Well stay tuned…

For more economic insight into Australia’s employment market, please contact our specialist directly.

Senior Consultant