The drivers for this growth were multi-faceted, though Government stimulus through programs such as Homebuilder and JobKeeper had a significant impact. Guaranteed record low interest rates helped. The inability to spend your money on overseas holidays also contributed. The low level of housing available to buy (reduced supply) was also an important factor.

One of the less highlighted factors has been the relative increase in personal value attributed to a home verses other forms of property. Covid highlighted the importance (and value) of our homes for working, studying, recreating, and shopping. Effectively reducing the value of these corresponding property assets in favour of our homes. It also highlighted the safety aspect of our homes and also initiated a desire for increased space within our homes, subsequently increasing demand for larger homes.

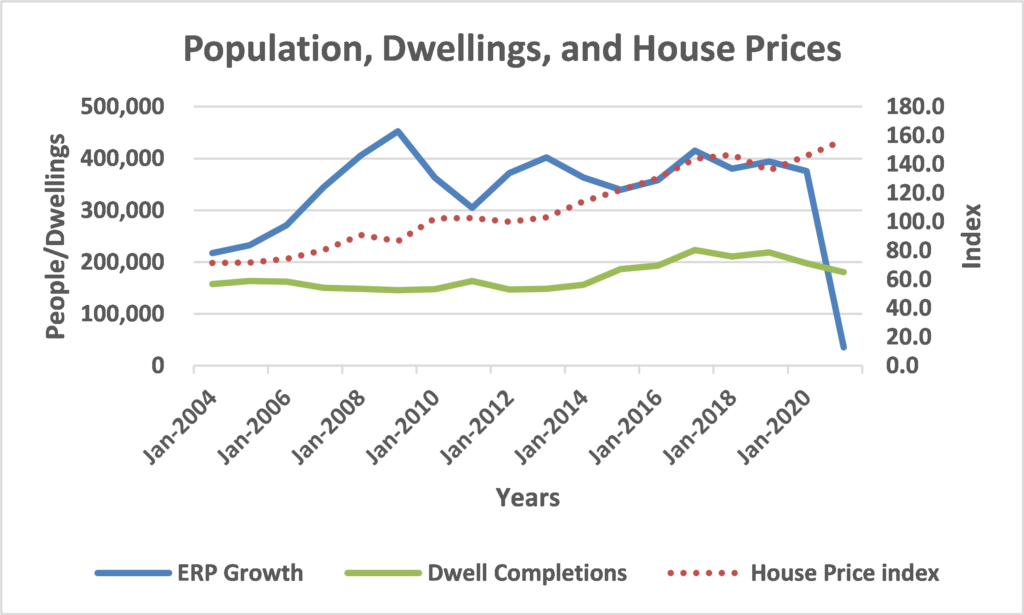

But back to some of the things that haven’t made sense during the pandamic. From March 2020 Australia closed its international border and subsequently saw population growth plummet (the blue line in the following chart). In a bid to keep the economy going the Federal Government introduced Homebuilder amongst other stimulus measures and this has largely been successful in keeping the residential building industry going (the green line in the following chart). In hindsight this has been too successful and with supply constraints, and labour shortages, the residential construction industry is now facing challenging circumstances.

Source: ABS Population, Dwelling Completions, House Price Index, 2021

So, while population plummeted and housing building continued, we expected that house prices would fall – the basic principles of supply and demand. However, as we noted above, house prices took off – the red dotted line in the chart above (for the above noted reasons). This however cannot last. Supply and Demand relationships are not dead, just temporarily misaligned due to Government influences.

What we have to be careful about now is the double whammy of excess Supply and rising interest rates, because if this happens there could be pain for home loan borrowers who have stretched themselves. The banks have already started increasing their fixed interest rates even though the Reserve Bank is holding out on its optimistic expectation of not increasing rates until 2024. With expected rises in interest rates the banks are now revising their house price growth forecasts for 2022 and forecasting a fall in 2023.

We are on a roller coaster and unfortunately the ride hasn’t finished yet.

For more economic insight into Australia’s economic market, please contact our specialist directly.

Senior Consultant